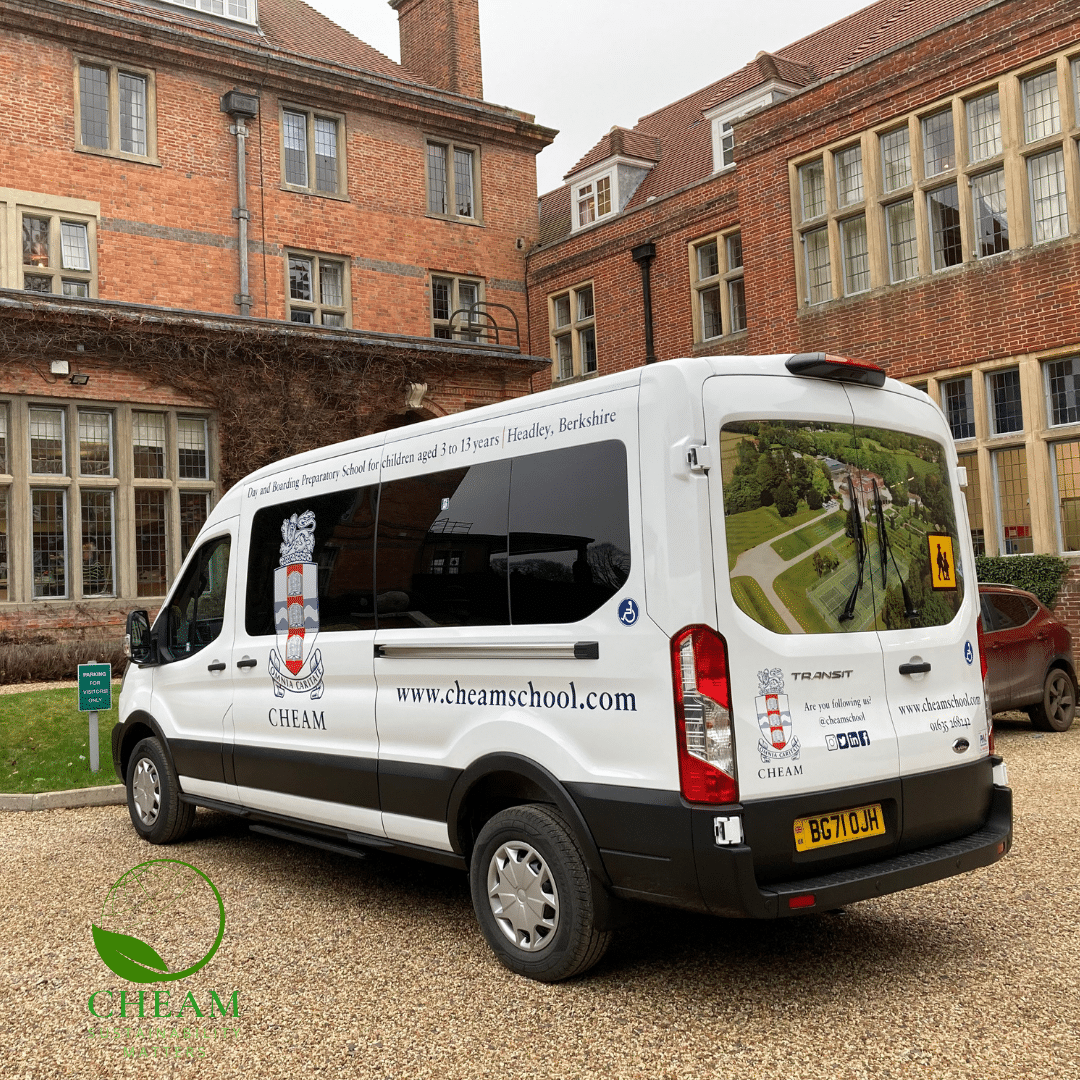

Cheam offers a challenging and stimulating curriculum, fantastic facilities, and a dedicated and experienced faculty. We believe that every child has unique talents and interests, and we strive to provide an environment that allows each child to reach their full potential.

Our admissions process is designed to give families a thorough understanding of our school and the opportunity to see if it is the right fit for their child.

We look forward to getting to know you and your family and helping you navigate the admissions process.

Experience Cheam

Open mornings

Termly - 3 per year - next on: 01.3.24We warmly invite families at our forthcoming Open Mornings and see first-hand why Cheam is such a special and inspiring place.

Find out moreArrange a tour

upon requestThe best way to experience Cheam is to arrange a personal tour and an appointment with the Headmaster and Head of Pre-Prep.

Find out moreFamiliarisation day / stay and play

Once termly, next on 23.2.24Once registered, children are invited to spend some time at Cheam, either in a Stay and play (nursery to Year 1) with their parent or for a Familiarisation Day for older children (Year 2 upwards).

Find out moreToddler music

Weekly on ThursdaysToddler music class is a fun class for prospective parents and their 1-3 year olds. Open to all local community members

Find out more

How to register your child

Where our students go next

We’re incredibly proud that our pupils go on to a wide range of leading schools throughout the country.

The quality of the pupils' achievements and learning is excellent. The school fully meets its aims to educate the whole child so that pupils realise their potential. Pupils of all ages, needs and abilities are successful in their learning. Achievement in the EYFS , and all year groups is excellent...

Independent School Inspectorate

Reviews and awards

We’re incredibly proud that our pupils go on to a wide range of leading schools throughout the country.

Useful links

In the spotlight

Meet the dedicated and experienced staff who make our school a special place for your child. With a diverse set of backgrounds, interests and skills, they all share a commitment to excellence in education.